The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

What type of inflation protection are LTCI policyholders buying today?

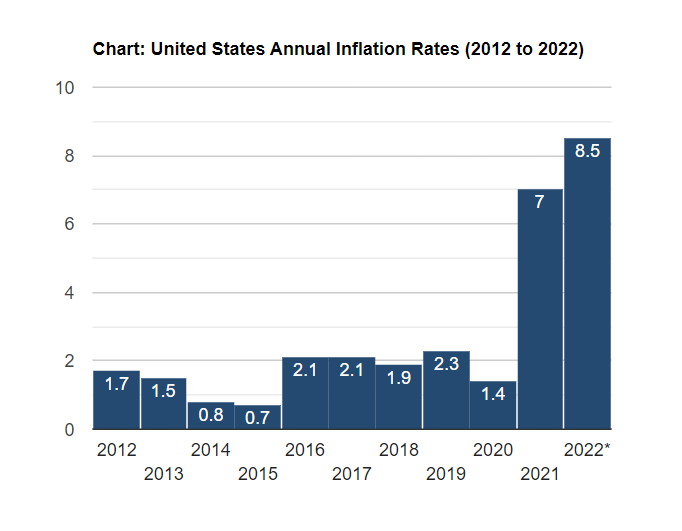

Source of Photo: USInflationcalculator.com

Long-term care insurance is bought when someone is "young" (50's) and healthy and is typically used when "old" (80's and 90's). Since an initial benefit is chosen to cover the current costs of long-term care, policy riders that increase coverage over time have always been a LTC option.

Deciding which inflation rider to add to a long-term care insurance policy is an inexact science. If you overestimate the inflation rate you'll end up with too much benefit - and you can't do much with excess LTC coverage. On the other hand, not having enough coverage to pay for meaningful benefits because inflation wasn't accounted at the time someone bought a policy is also a problem.

We recently analyzed over 25,000 LTC insurance policies that our business participated in since 2011 to get a idea of trends in inflation coverage. We included individual, group, and linked life/ltc plans from a variety of carriers including John Hancock, Genworth, Transamerica, Mutual of Omaha, and others.

We categorized the inflation coverage into five categories to look at trends. We then calculated what percentage of the overall policies fell into different categories, and put the percentages in the table below. Here is what we found:

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| No Inflation or GPO | 2% | 4% | 8% | 14% | 16% | 29% |

| 3% Compound | 25% | 34% | 43% | 53% | 45% | 45% |

| 5% Compound | 52% | 48% | 30% | 12% | 4% | 3% |

| Increasing Premium | 0% | 0% | 0% | 1% | 10% | 15% |

| All Others | 29% | 21% | 23% | 19% | 30% | 8% |

-

GPO or No-Inflation. These are plans that either include guaranteed purchase option that allow people to buy inflation periodically, such as every three years, at attained age rates. Some products don't offer this option, and clients simply buy a big initial benefit . Many group offerings default to GPO options and allow buyers to get in at a more affordable premium. As polices have become more expensive, we've seen a big increase in choosing this option. In addition, many popular Linked Life/LTC plans are purchased without automatic inflation protection included.

-

3% Compound Automatic Increase. The automatic 3% Compound rider has been the most popular inflation option for the last several years and represents almost half of coverage bought. There are a couple of reasons why 3% compound is so popular. First, it is easy to understand and tracks long-term historical inflation pretty well (although for the past decade 3% has been greater than the average rate). Second, many plans meet the criteria for state partnership protection. An issue is cost - the rider is expensive compared to some other options.

-

5% Compound Automatic Increase. Despite the fact only a handful of people still purchase coverage, carriers are still required to offer 5% compound inflation coverage by law! Until 2013, 5% compound was the most popular inflation coverage selected. However, actuaries priced 5% compound coverage in new products so high that very few people now purchase it. As we will discuss below, many people who originally bought 5% compound have comfortably reduced their inflation percentage. The insurance industry is lobbying regulators and government to remove the mandatory 5% compound offer.

-

Increasing Premium Products. This inflation option represents almost 15% of the riders chosen in 2016. What constitutes increasing premium LTC products? These products increase the benefit pool and premium. One example of these products include step-rated products, such as those offered by Transamerica and Genworth. Step-rated products increase the premium and benefit each year. In some cases, consumers have the opportunity to stop and re-start the increase options. For example, if the benefit increase has outpaced the cost of care it might be wise to stop the premium increases. Another type of increasing premium product allows the underlying performance of the insurer's investments to be offset against the premiums. Examples of these policies include Northwestern Mutual issuing dividends and more recently John Hancock with their Performance LTC product . Increasing premium policies can give more control to the policyholder to adjust to inflation trends, are rapidly increasing in popularity, and may represent the smartest purchase.

-

All Other Options: In doing our analysis, there have been well over 100 different types of inflation coverage offered by carriers over the last five years! Examples of the other inflation choices include 1%, 2%, or 4% compound inflation, 3% or 5% inflation that compounds at a simple rate, inflation that is "capped" at some percentage of initial benefit, such as 2x; "tailored inflation" that starts out at 5%, moves to 3%, than stops at a certain age, and other options. Many options that are included in this large category include automatic CPI coverage, which is no longer available.

What are some conclusions from our findings and how can you help your clients make smart decisions?

-

Don't confuse the Health Care Inflation rate with the cost of long-term care. Although some long-term care covered by policies is impacted by hospital and doctor charges, the majority of custodial care is a function of labor and real estate rates and those costs have been similar to overall CPI . The exception is nursing home rates, which have increased due to factors such as cost shifting due to low Medicaid reimbursement. However, since more care is private pay at home or assisted living advisors should design plans based on those costs.

-

It's more critical than ever to schedule an in-force policy review periodically. Because of the greater flexibility of many inflation options, policyholders should not just buy their policy and forget about it. Instead, they should talk to their advisor periodically to make sure that the current plan is keeping up with the cost of care so that the right decisions can be made. Some companies are sending annual policy statements or providing better online policy information to make that easier.

-

People are changing their inflation protection over the course owning their policy. With all the in-force premium increases occurring, many carriers have created "landing-spots" to allow policyholders to adjust their inflation percentage. For example, my in-laws started with 5% compound inflation on the policies they purchased several years ago. By adjusting their inflation coverage down to a .5% compound rate going forward, they've been able to keep their premium the same even though their policy series has been through two rate increase cycles. They are comfortable with that choice because their policy has more than kept up with cost of local care.

-

Many state Partnership Plans require inflation protection. If you have a partnership plan, they require some type of inflation protection. It varies by state, but many states have revised their minimum inflation requirements down.

-

Innovation is good. Although choices are confusing, it is important to allow the best ideas to come to the marketplace. If long-term care policies were standardized with, for example, a 5% compound inflation requirement, the impact on the market would be dire. Many seasoned insurance advisors were used to selling 5% compound plans and they need to learn about the new options.

-

Focus on premium first. You can design long-term care plans to cover the most expensive care in the world and compound benefits at 5% - but the premiums will be unreasonable. Instead, consider a Good, Better, Best Sales Approach so that people can select a policy that reflects their budget.

Again, it's really hard to predict what the cost of care will be in the future. The only thing for certain is those without any plan will most the most negatively impacted. What do you think?