The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Why the latest research on LTC planning could be good news for advisors

Do you think you'll need long-term care at some point in the future? Where do you want to receive that care? Who is going to pay for it? Have you talked to friends or family members about your desire for care?

These are typical questions that need to be answered when creating a plan for long-term care. As an advisor, you've probably asked some version of these questions to many clients who are 40+ years old.

Each year, variations of those questions are asked by the Associated Press - NORC Center for Public Affairs research at the University of Chicago. (The website address is pretty easy to remember - www.longtermcarepoll.org) . The survey is one of the best funded and comprehensive studies done each year. And the results show there are a lot of opportunities for advisors who can help people plan.

You can check out the entire report here. What are the most important takeaways from the report? Here are four of the more compelling:

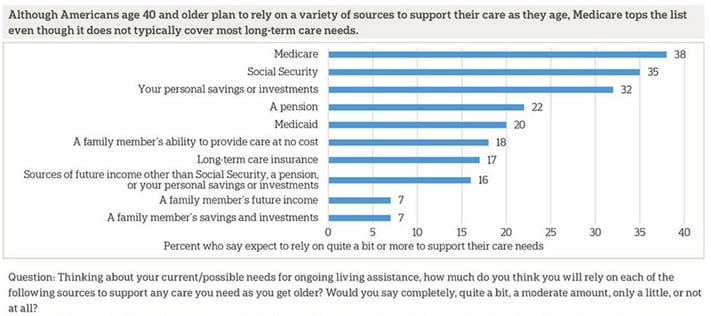

1: People still think Medicare is going to pay for their care. Almost 4 in 10 respondents think that Medicare is going to pay for "quite a bit" of their care. These are either people that expect a federal LTC expansion through Medicare or are just unaware of the fact that Medicare doesn't pay for a lot of LTC expenses. Regardless of the reason for the confusion, there is opportunity for education here.

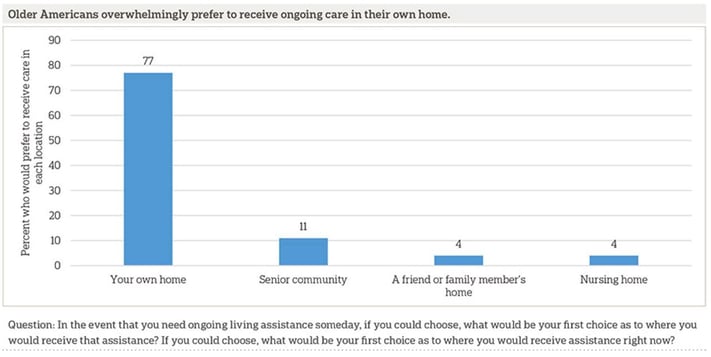

2. People want their care to happen at home. This is not a surprising finding, but it is still instructive how overwhelming the desire to stay at home is. The lesson is clear - help people plan for home care, and design long-term care plans that focus on home care benefits.

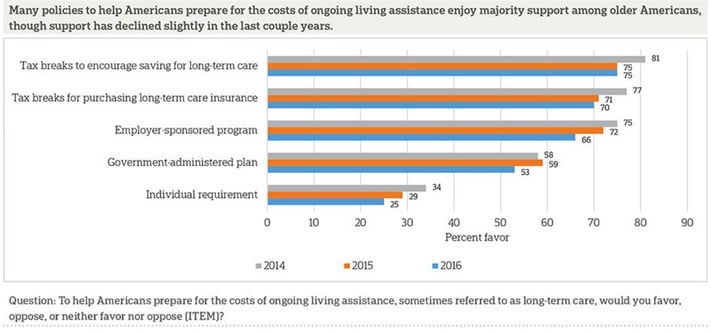

3. People want tax breaks to pay for a long-term care plan. What can the government do to help plan for LTC? It's not a government run LTC plan. Instead, respondants want tax breaks for LTC coverage including being able to use pre-tax dollars for LTC insurance. The lesson here - many people may not be aware of the current tax advantages , including being able to use HSA dollars to pay premiums.

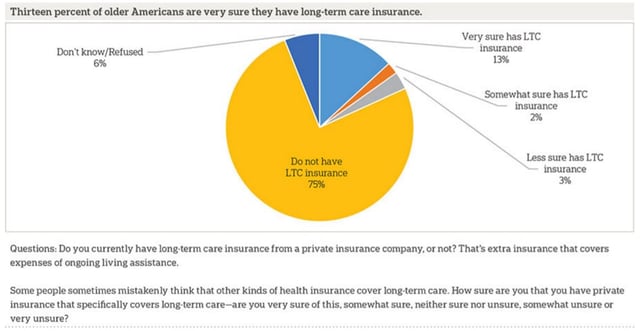

4. Still a lot of people are uncertain if they have private LTC coverage. Thirteen percent of people 40+ are certain they have private LTC coverage - a higher market penetration than the actual numbers support. 75% of respondants (correctly) report they don't have coverage. On a postive note, of those who have coverage, the research shows that almost 70% are "somewhat or very" satisfied with their premium cost while only 16% are unsatisfied.

The survey results should be encouraging advisors to helping people plan for care. For those who don't have LTC coverage, they may be surprised at how affordable it may be. For those who have a plan, a policy review may be in order.

You may be interested in:

![LTCI Partners Advisor Assisted Sale Service [ 71 second video ]](https://no-cache.hubspot.com/cta/default/405630/4646b9f8-ffe3-45a8-a6d2-c86101ef82c2.png)