The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Designing an "affordable" linked LTC Insurance policy

There are many advantages to hybrid life/LTC plans - a death benefit in case LTC benefits aren't used, premium guarantees and return of premium provisions. For people who aren't convinced they'll need long-term care, the opportunity to get something out of the premiums they are paying makes a lot of sense to them.

For many years the vast majority of linked life/LTC plans were single premium. In fact, the name most often used was "asset-based" plans because buyers would shift an asset, such as an expiring CD, to the hybrid plan. People who didn't use this approach bought traditional LTC with annual pay premiums.

As we know, however, traditional LTC sales have declined and not every couple has a couple hundred grand just lying around to fund a single premium policy or wants to tie up that amount of assets to do so. Also some people are high earners but for whatever reason have not accumulated a lot of liquid assets outside of qualified plans or real estate to fund a plan.

For those people there are options in hybrid policies that can lower the premium while maintaining effective LTC coverage. Here are some strategies to lower the initial premium at younger ages while still building up meaningful LTC benefits in later years:

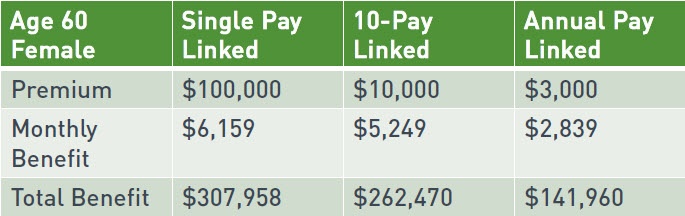

1. Consider pay options beyond single pay. Many carriers offer premium pay options that stretch out the premiums over longer years - even lifetime pay options. Since premiums and benefits are guaranteed, there is no uncertainty regarding rate increases in the future. Below is an example of a 60 year old female and the total benefit they would be eligible for from paying premiums one time, over 10 years, or annually. Of course the benefits are higher for the single pay - thanks to the magic of the insurer investing the money. In addition, the multi-pay option include a waiver of premium provision once on claim - similar to standalone coverage, an additional charge compared to the self-insurance feature of a single pay plan.

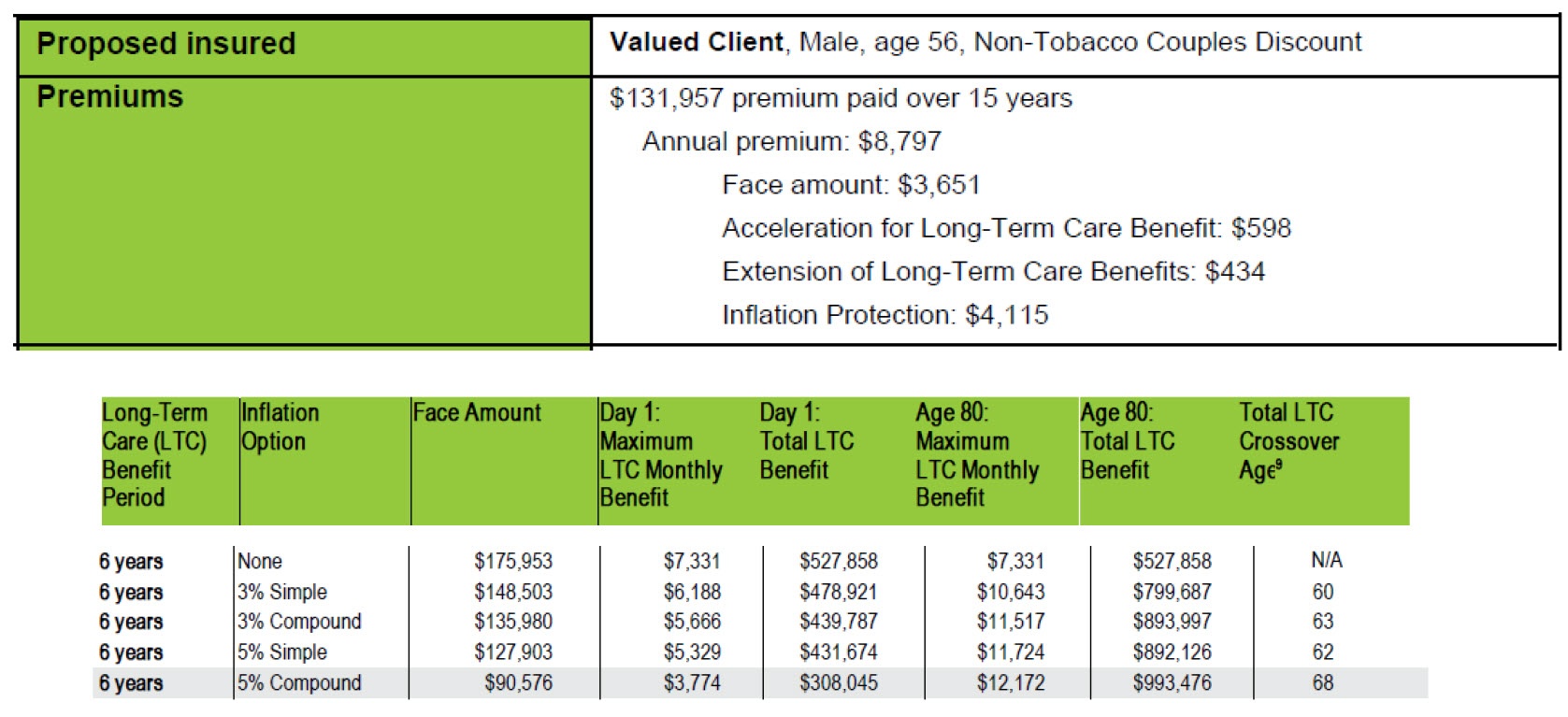

2. Use automatic inflation coverage to increase benefits over time. More and more linked policies are being written with automatic inflation protection allowing the benefit to start smaller and grow overtime. Consider the example below:

As you can see, for a 56 year old with an annual premium amount of $8,797 over 15 years the best option might be a plan with a 5% compound inflation rider, which will lead to the highest total LTC benefit at age 80 - the age when he may need care. The downside to that selection is a lower initial death benefit - but most people are buying linked plans to cover the long-term care need, not the life insurance need.

3. Consider return of premium on a traditional plan. Although only linked plans offer guaranteed premiums and a cash surrender option, you can still get a death benefit (in the form of a return of premium) on traditional LTC plans. This should help answer the "what if I never use coverage" argument. As an example, using our 56 year old male client above if they purchased a traditional LTC plan with a $3,000 per month benefit, a $300,000 benefit pool increasing at 3% compound inflation the annual premium with one carrier would be about $1,900. If they selected the return of premium upon death rider, which would return all premiums paid (less claims) to a beneficiary, the annual premium would be around $2,700. Therefore, if that client died at age 86 without using the policy, their beneficiary would get about $81,000 back.

Bottom line - there are LTC Insurance plans available for every budget. The only obstacle is wanting to put a plan in place and being healthy enough to qualify for coverage.

Want to see an overview of the some of the linked life/LTC plans available? You can download a guide to the products here. For a more detailed look at Linked policies, check out this webcast.