The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

We rate long-term care insurance e-applications

Long-term care insurance carriers have made tremendous strides in application technology. They have taken a process that required long and tedious paper applications with many physical touches to an easy electronic process. We decided to take a look at some of LTC carriers e-apps and give ratings for each one. Regardless of how they ended up being rated, all of the e-apps are much better than the paper alternative!

One caveat, however. All e-app platforms require the agent to be properly licensed and appointed with the carrier and in their state of residence as well as the state of residence of the client(s). in addition, the agent must also have the appropriate LTC training for their state. All of this must occur before the e-apps can be used. If you need to get an application done immediately and you aren't completely set up to do so you'll have an alternate method.

Let’s start the breakdown!

John Hancock Captivate 2.0

(5 stars)

John Hancock’s Captivate 2.0 online e-application is one of the best in the business. The e-application is intuitive for the agent as well as the client. The Captivate 2.0 system allows for the agent to essentially build a case and share the planning aspect with the client all the way through with unique links. The client is able to enter through their own portal and see only what the agent wants to share.

intuitive for the agent as well as the client. The Captivate 2.0 system allows for the agent to essentially build a case and share the planning aspect with the client all the way through with unique links. The client is able to enter through their own portal and see only what the agent wants to share.

Pros of Captivate 2.0

- Ability to run quotes and apply immediately.

- Clients can see the running of the quotes in real time or later through unique links and client login that they create themselves.

- Clients can apply themselves by using e-signature; the agent doesn’t even need to be present.

- Screen sharing is available through the system.

- Agent has the ability to use licensed sales support staff by giving permission of use.

- Step-by-step navigation, the client cannot physically move forward until all necessary parts are completed.

- The system specifically alerts when there is missing information and what needs to be filled in.

Cons of Captivate 2.0

- There is a lot of upfront work / planning that goes in before the client can go in the portal on their own.

- Each support staff member needs to create their own login and password and the licensed and appointed agent needs to allow permission for multiple people if there are multiples.

Genworth Quick Request

(3.5 stars)

Genworth Quick Request has the fastest e-application process. The questions are simple and straight forward for the client and the agent. Genworth also has an eValuate Field Underwriting tool within the Quick Request system which allows for clients to be pre-screened prior to taking the application since very little health information will be collected initially.

Pros of Quick Request

- Speed – completing a Quick Request application only takes a matter of 10 minutes.

- The application starts with a quote so that you and the client can see the premium and confirm the benefits.

- The application is intuitive and will not allow for progression forward until all necessary information is completed.

- Agent signatures are collected immediately by authorizing the process electronically.

- Client signatures are collected via voice authorization on a second phone call from Genworth.

- Completed application and leave behind materials are generated immediately from the system and sent to the client.

Cons of Quick Request

- There is a second call from Genworth to collect additional information and voice authorization signatures. If this isn’t clearly communicated to the client there can be a lot of confusion on why there is a second call regarding their long-term care insurance policy.

- The paramed call is either scheduled during the second call or yet another phone call for a visit to their home or office.

- The entire application process can feel like it is 3 or more steps for the clients which can cause frustration.

LifeSecure E-Application

(4.5 stars)

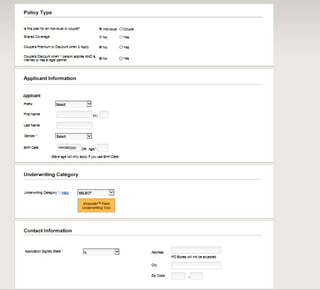

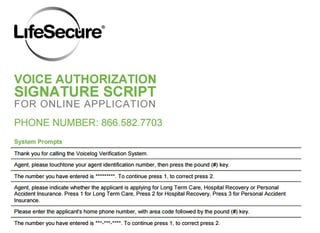

LifeSecure was one of the first insurance carriers to embrace an electronic application. Since LifeSecure has been doing the electronic process from the beginning, it is a very easy step-by-step process for the agent to complete with their clients.

Pros of LifeSecure’s E-Application

- Easy process - starts right from the agent home page and is a step-by-step process that will not allow you to move forward until everything is completed.

- You can begin in the Quote Calculator module and from there, begin your application once the client decides on the premium and benefits.

- Agent calls for signature during completion of the application which puts the e-app immediately to underwriting.

- Allows for e-signatures via 'write it or type it' methods. The 'write it' allows the user to sign immediately using their mouse. Alternatively, the user can simply type his/her signature.

Cons of LifeSecure’s E-Application

- No ability for support associates to take an application on the agent’s behalf.

MedAmerica Contego

(4 stars)

MedAmerica recently came out with their electronic application with the release of their new product Contego. MedAmerica worked with many agents to creat the new e-app which is obvious with the ease of use for agents and clients.

Pros of Contego E-App

- Easy to begin the process; the portal asks basic client questions to start a case.

- Red alert if anything is missing on the page and a green check mark once everything is completed.

- Insurability questions are first on the application to stop the process if a client answers yes to a knock out question.

- Signatures are taken by screen sharing or via e-mail with a unique link for the client to do on their own.

Cons of Contego E-App

- Cannot complete a couple at the same time, there is a copy information to spouse feature but you cannot simultainously complete an application for the couple at the same time.

- Cannot have support associates help with applications.

Mutual of Omaha E-App

(4 stars)

Mutual of Omaha recently created an e-app system which is similar to the normal application, essentially a fillable PDF, however, it’s a smart fillable PDF which alerts you when there is missing information.

Pros of Mutual of Omaha E-App

- Intuitive, fills in like a regular application.

- There is a “sandbox” feature which allows agents to practice before taking an actual application.

- Uses e-mail signatures for the agent and the client.

- Can fill out the husband and wife at the same time.

Cons of the Mutual of Omaha E-Application

- Cannot set up for a support associate to take an application.

- Long application since it is essentially the full fillable PDF.

Transamerica E-App

(3.5 stars)

Transamerica was one of the first carriers to embrace an E-system. The e-application has fields designated to be filled out and no information can be missed because it will not allow the agent / application to move forward until all field are available.

Pros Transamerica E-App

- Intuitive system no applications can be submitted without complete information.

- Secure e-mail signature process, the client must answer 3 authorization questions to sign the application.

- Immediate submission to Transamerica.

Cons Transamerica E-App

- Must physically sign a form and submit to Transamerica prior to being able to do an e-application.

- No support associate ability.

**E-app is not available in all states.

Not interested in doing any work? Try our Application Partner Service...

Application Partner