The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Why it's worth your time selling long-term care insurance

The long-term care insurance (LTCI) industry has certainly seen its ups and downs during its 40+ year existence. Carriers have dropped out, products have changed, but the need for long-term care planning has not gone away. In fact, it's more important than ever with roughly 10,000 baby boomers turning 65 each day1. Add to that the fact that the lead LTC insurance carrier has paid out more than $12.6 billion in long-term care insurance claims2, and you can see there's clearly a huge market need for this coverage.

To some of you this may be nothing new. You know how important it is for your clients to have protection from devastating financial risks like a long-term care event. But other than the satisfaction of protecting your client's assets, what's in it for you?

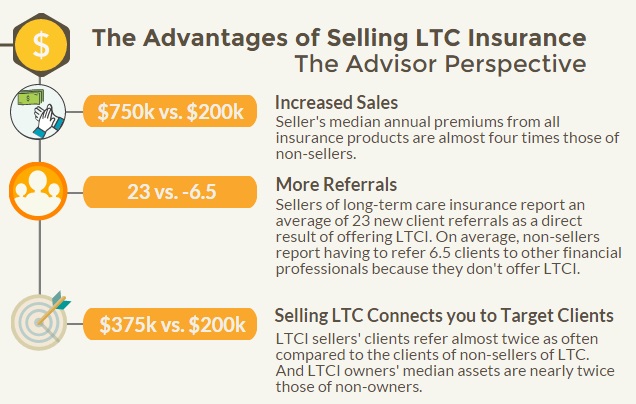

Consider the following stats on the benefits of selling long-term care insurance:

All those are compelling reasons to look at offering both standalone and linked offerings. In addition, the compensation for placing coverage is attractive as well.

There are risks, however. The main risk is of a client being declined due to poor health. Also, since offering LTC coverage is rarely the advisors primary business, the complications of product and plan design and the application process can be expensive - because every case becomes a new experience. A good way to alleviate that cost is by have a good distribution partner for help with product specifics and completing applications.

Put the priority on having a high level discussion with people on the consequences of an extended health care event. Remember, if you aren't discussing long-term care planning with them, then who is?

Stay tuned for our post next week in which we'll discuss the benefits of buying long-term care insurance.

1. Pew Research Center

2. Genworth Financial Claims as of 06/30/15. "Keeping our Promises" Genworth brochure.

3. Stats for infographic come from "Genworth Long-Term Care Insurance Unwrapped," October 16, 2014