The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

How low interest rates are changing LTC Insurance products

The last several years have seen major changes in LTC Insurance - leading to what can be referred to as LTC 2.0. LTC 2.0 means that while the pure protection of traditional LTC insurance is still a popular option, there has been an accompanying growth in Hybrid LTC + Life plans - both in number of policies sold and number of carriers offering these plans.

However, the extended and record low interest rate environment may threaten some of the most popular provisions of these plans - including benefit guarantees. How are carriers responding with new innovations? This article will discuss that topic.

For those who aren't familiar with the newer Hybrid LTC + Life Insurance products, they bridge the gap between the "pure" LTC protection of traditional LTC plans and the more life insurance and investment based products offered by permanent life products with living benefit riders.

You can tell a Hybrid LTC + Life plans from a Life insurance plan with a LTC acceleration rider because these plans typically have the word "care" in their name (such as One America AssetCare, Securian SecureCare, Nationwide Care Matters) and offer an extension of benefits rider (EOB) so that the maximum long-term care benefit available is much greater than the death benefit of the life policy. As an example, a $100,000 death benefit on a Hybrid LTC + Life plan may result in a LTC benefit of $300,000 or more - plus an optional inflation benefit can raise the benefits even higher.

An appeal of these plans compared to traditional LTC insurance has often been the certainty of premiums and benefits. Most of these products offered guaranteed premiums - so a policyholder has that certainty, whether the premium payment period is 5 years, 10 years, or beyond. This appeals to buyers who may be concerned about the non-guaranteed premiums of traditional LTC Insurance, even though newer traditional products are less susceptible to premium increases.

In addition to the premiums, most Hybrid LTC + Life plans also offer guaranteed benefits in the future. This means a buyer who purchases a Hybrid LTC + Life plan with a 3% inflation rider will know EXACTLY what their benefit will be at a certain age when care might be necessary. This certainty of LTC benefits can allow a policyholder to be more aggressive with other investments, realizing the risk is transferred to the insurer vs. themselves.

That's great for the policyholder, and for those who have purchased LTC Insurance. Congratulations - you won, and made a very smart choice.

For carriers, however, the challenges are building. Carriers are pivoting away from products that have become capital intense amid the prolonged low interest rate environment. As an example, Prudential recently decided to discontinue sales of variable annuities with guaranteed living benefits, attempting to reduce their exposure to interest rates. Transamerica joined them recently by stopping the sales of traditional LTCI and fixed annuities, announcing it at their recent Capital Markets Day.

It's obvious many carriers want to detour away from some of these risks, so they are coming up with products that have more variability in their plan design to account for different economic environments.

One example is a carrier who has introduced a Linked LTC + Life product using an Indexed Universal Life Chassis. The product illustrates LTC insurance very well using current assumptions for the growth of the stock market. Here's an example.

Consider a 55 male who purchases a $100K single premium Hybrid LTC + Life Product. One option is from Carrier "A" that offers certainty of benefits. The other option is from Carrier "B" that uses the Indexed Universal Life Chassis.

| Product | LTC Growth Option | Initial LTC Benefit Pool | Age 80 LTC Benefit Pool | Age 80 Cash Surrender Value | Age 80 Death Benefit |

| Carrier "A" - Linked LTC + Life plan with certain benefits | 3% compound | $382,032 | $837,193 | $86,550 | $127,340 |

| Carrier "B" Linked LTC + Life IUL plan with illustrated benefits | Indexed LTC growth | $496,728 | $949,017 | $146,402 | $208,037 |

| Carrier "B" Linked LTC + Life IUL plan with guaranteed benefits | Indexed LTC Growth | $496,709 | $496,709 | $0 | $174,284 |

Both solutions offer a high multiple (leverage) from the original premium paid for LTC benefits. However, for the Indexed product the multiple at age 80 ranges from about 5x the initial premium to 9.5x the original premium depending on the performance of the stock index. The more standard carrier has a known LTC benefit at issue age.

What's the right answer? Like all decisions, it depends. One could argue that the long time horizon of the applicant means they should take advantage of the market growth potential and choose the Indexed product. On the other hand, someone who has the certainty of the fixed benefit product may be able to be a little more aggressive with other investments.

In addition to the Indexed product shown, another carrier is planning to offer a Hybrid Variable Universal Life (VUL) + LTC plan - with even more potential upside in the policy.

When looking at certainty of premiums and benefits, here's a comparison of the certainty of premiums and benefits for different long-term care insurance products.

| Certainty of: | Traditional LTC | Guaranteed LTC + Life Linked Plans | LTC + Life Indexed Universal Life Plans | LTC + Life Variable Universal Life LTC Plans |

| Premiums | No | Yes | Yes | Probably No |

| Benefits | Yes | Yes | No | No |

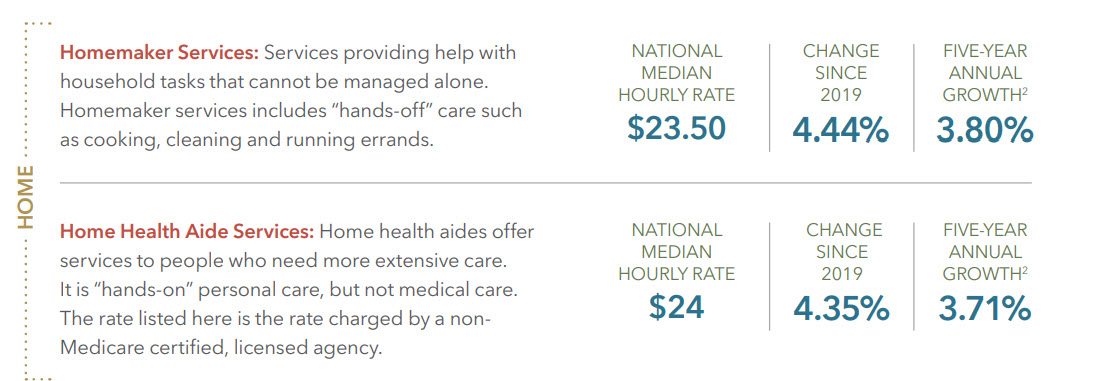

At the same time interest rates remain ultra-low impacting carriers, the inflation rate for home healthcare is increasing. Genworth recently released their 2020 cost of care survey, and found that home care prices have increased over 4% in 2019 due to a variety of reasons.

These are challenging times for everyone - caregivers, people needing care, nursing home residents, everyone is struggling. LTC Insurance can make a gigantic difference in people's lives to help them pay for care.

However, too many people haven't yet made a plan for care. There are more and more insurance options available. The important thing is to plan now - when there are comprehensive and affordable options!