Consumer Planning Blog

Never miss any update

Subscribe to the Consumer Plannig Blog newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Long-term care survey finds majority of Americans not planning for the future

Did you know that by the year 2040, the United States population is anticipated to include more than 82 million persons over the age of 65? That’s more than double what it was in 2000! I think it is fair to anticipate that many of these 82 million Americans will require some form of long-term care as they continue to age. If you are among this group—or you know someone who is—having a plan in place should the need for long-term care arise is more than a good idea, but doesn't always occur.

Earlier this year, The Associated Press-NORC Center for Public Affairs Research conducted a survey of 1,735 adults age 40 and older across all 50 states to gain insight on the current understanding of long-term care in America. A few takeaways from the research immediately stood out to me:

- Only one-third of respondents said they are confident in their ability to pay for ongoing living assistance in the future

- More than half (54 percent) reported that they have done little or no planning for their future care needs

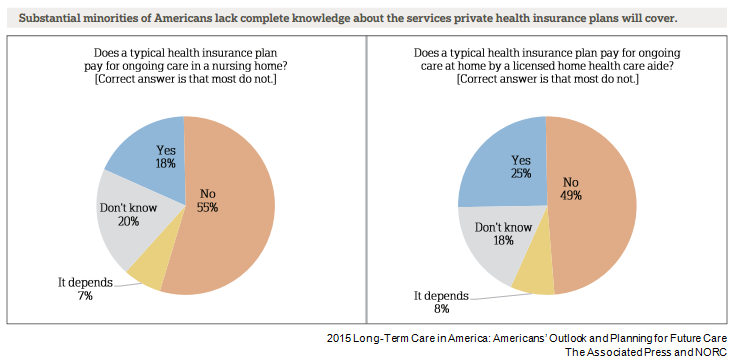

- 20 percent of respondents did not know if private health insurance would cover ongoing care in a nursing home

It's not always easy to plan for the future. However, if you are in the process of already caring for a loved one, or know someone who is, it is easy to recognize the need for a long-term care plan to be prepared for what may happen down the road. Even so, confusion or lack of information about how this care is paid for still exists.

According to the survey, more than one in four Americans age 40 and older are unsure whether Medicare pays for ongoing living assistance services like nursing homes and home health aides. A majority also continue to hold misperceptions about the role of Medicaid in financing long-term care in this country. While Medicare does cover short-term stays in a nursing home or help at home short term if needed, it does so under very stringent rules—and usually not long enough to take care of any issues at hand.

While you can’t predict exactly what type of care you or your loved one might need in the future, the good news is long-term care policies are now more flexible than ever with policy options that take into consideration your specific situation.

If you don’t have a plan for the future in hand today, I encourage you to do your research (here are five great websites to start with) to gain a complete understanding of the type of plan that works for you, your family and your budget. And then be sure to execute it.