Group LTC Benefits Blog

Never miss any update

Subscribe to the Group LTC Benefits blog newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

A better way to look at your HSA - pre-tax LTC.

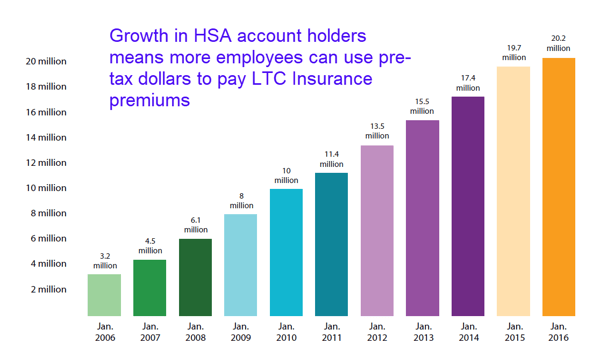

The growth in Health Savings Accounts over the last several years has been tremendous. More employers and employees are becoming comfortable with the plans and the flexibility they provide.

Long-term care insurance premiums don’t qualify as Section 125 pre-tax eligible. However, as more employees get HSAs and build balances, they will find that long-term care insurance is a natural fit. Health Savings Accounts can be used to pay LTC insurance premiums for employees and their spouses up to the annual tax limits shown here. As an example, if a 61-year-old employee and same aged spouse both have LTC insurance plans with a combined annual premium of $5,000, they can take that amount out of their plan to pay for the premiums using “pre-tax” dollars. That’s because the combined limit for couples between the ages of 61 and 70 is $8,320.

What if an employee isn’t able to pay their full LTC insurance premium from their HSA due to the limit associated with their existing age? The good news is that once they advance to an older age range, they can recoup the shortfall from previous years. For example, if an employee purchased LTC with a premium of $2,000/year when they were age 60, they would only be able to use $1,560 from their HSA and would need to pay the remaining $440 with after tax dollars. The next year, at age 61, their limit goes up to $4,160. They would be able to pay the entire $2,000 premium for that year from their HSA, as well as recoup the $440 they paid out of pocket the previous year. Since employers often provide funds to HSA for employees, those employees who wish to purchase LTC insurance have a nice pre-tax benefit.

Like what you're reading? Download the Essential Guide to Group Long-Term Care Insurance.

%20%232.png)