The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

What’s the best way to present Standalone or Linked-Benefits Long-Term Care Insurance?

Our answer to advisors is usually, “the same way you present everything else.” Consult first and sell second.

Ask your clients open-ended questions that will lead you (and your clients) to focus on discussing a financial, caregiving or emotional problem that the insurance can help solve. It’s likely that one or two of these concerns drives most sales.

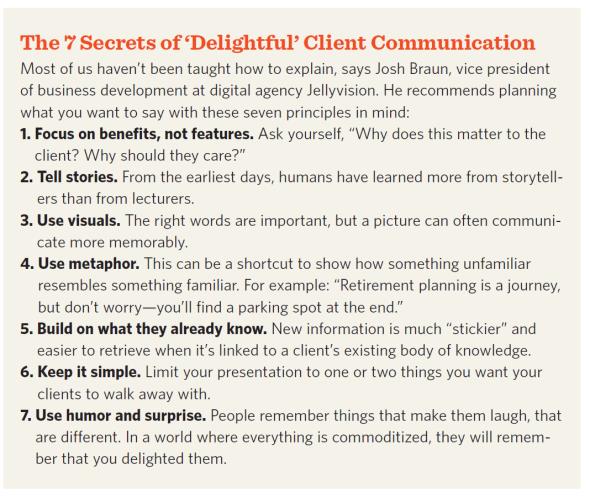

We’re often asked by advisors about best practices for presenting insurance solutions, reviewing illustrations and strategies for client meetings. What works? What doesn’t? What parts do I cover and what pieces should I avoid?

The key to success is no different than your success in other areas of your business (Life Insurance, Disability Insurance, Investments, etc.).

Here are a few reminders/best practices:

- Keep it simple and straightforward (KISS)

- Synthesize all of the data clients have in front of them into bite-size pieces

- Don’t let the illustration do the talking for you – have a conversation vs. presenting #’s

- Price is the ONLY thing in the absence of value

- There’s truth to that old saying, “paralysis by analysis”

- Ask for help – LTCI Partners can assist and provide “virtual” point-of-sale support

Source: http://www.investmentadvisordigital.com/investmentadvisor/november_2014#pg62

%20%232.png)