The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Why a long-term care policy with 50% coverage for home health care might make sense

We know that buyers of Long-term care insurance love the fact that coverage includes home health care. More and more claims are paid at home, and every plan available today includes coverage for nursing home, assisted living and home care.

In fact, to keep plan design simple plans today most plans today cover the cost in any of these settings up to 100% of a chosen monthly maximum, such as $6,000.

100% wasn't always the most popular option, however. Way back in the 90's, many policies were written with coverage that paid up to 50% of the chosen amount for home care.

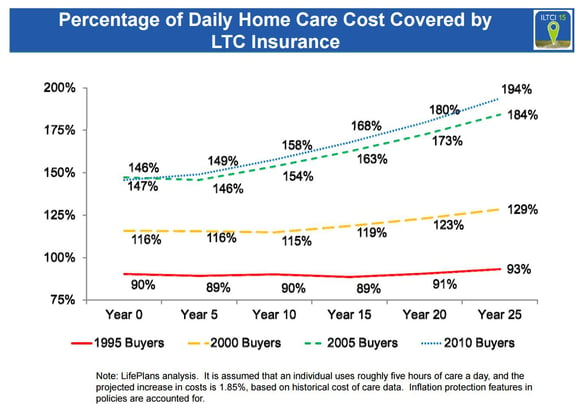

Surprisingly, that 50% home care coverage amount was very accurate. Looking at the chart above, it demonstrates that actual claims of home care were almost completely covered with coverage bought in the 90's. On the other hand, more recently policies have purchased "too much" home health care coverage.

The brand new 2015 Genworth cost of care survey validates this fact - the average home health care aide is $45,000 per year while a private nursing home cost is $91,000 per year.

Using the averages above, you may want to consider a plan of $8,000 for nursing home coverage and 50% of that, or $4,000, for home care coverage.

Regardless of the percentage, home care coverage is crucial. Here is a recent Genworth claim story that drives the point home very well.