The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Are Consumer Long-Term Care Insurance Seminars Dead?

Quick Answer – “No.” There are many advisors that find this type of activity effective for client communication and prospecting.

Longer Answer – They might not be dead, but they are certainly changing. We’re inclined to give you a definite, “maybe.”

It’s getting tougher and tougher to conduct these seminars today as opposed to several years ago. Your clients are changing…society is changing…and technology is changing everything. Today, there might be more effective ways to educate/inform or gain clients. The typical long-term care insurance buyer in 2014 is 50-something, employed full-time, has children and is really BUSY. Ten years ago, the typical buyer was in his or her late 60’s and retired. So a morning, lunchtime or evening seminar was do-able. You’ve even heard yourself say this, “I wish there was more time in the day.” New communication strategies can do just that – give advisors and their clients more time. What are we saying? More and more successful advisors are conducting webinars or virtual meetings with clients (using tools like WebEx, join.me, AdobeConnect, GoToMeeting, Glance, Zoom, etc.). This is a creative way to stay visible to your clients without the time required and expenses associated with a long-term care insurance seminar. These education sessions usually last only 30 minutes, including Q&A.

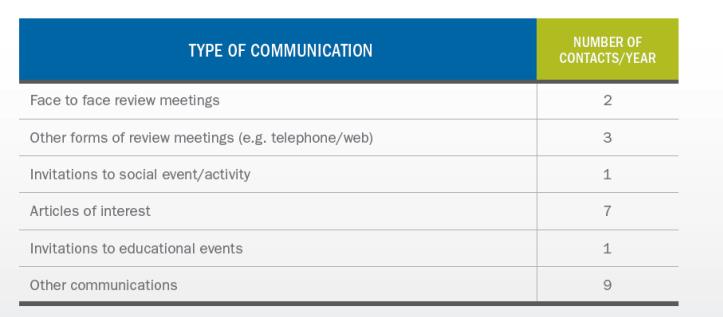

Recent Findings from the Financial Planning Association

Source: http://www.onefpa.org/businesssuccess/ResearchandPracticeInstitute/Documents/FPA_RPI_Q_Report.pdf

%20%232.png)