Group LTC Benefits Blog

Never miss any update

Subscribe to the Group LTC Benefits blog newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

LTC Legislative Discussions: We Need to Get “Schooled” in CA

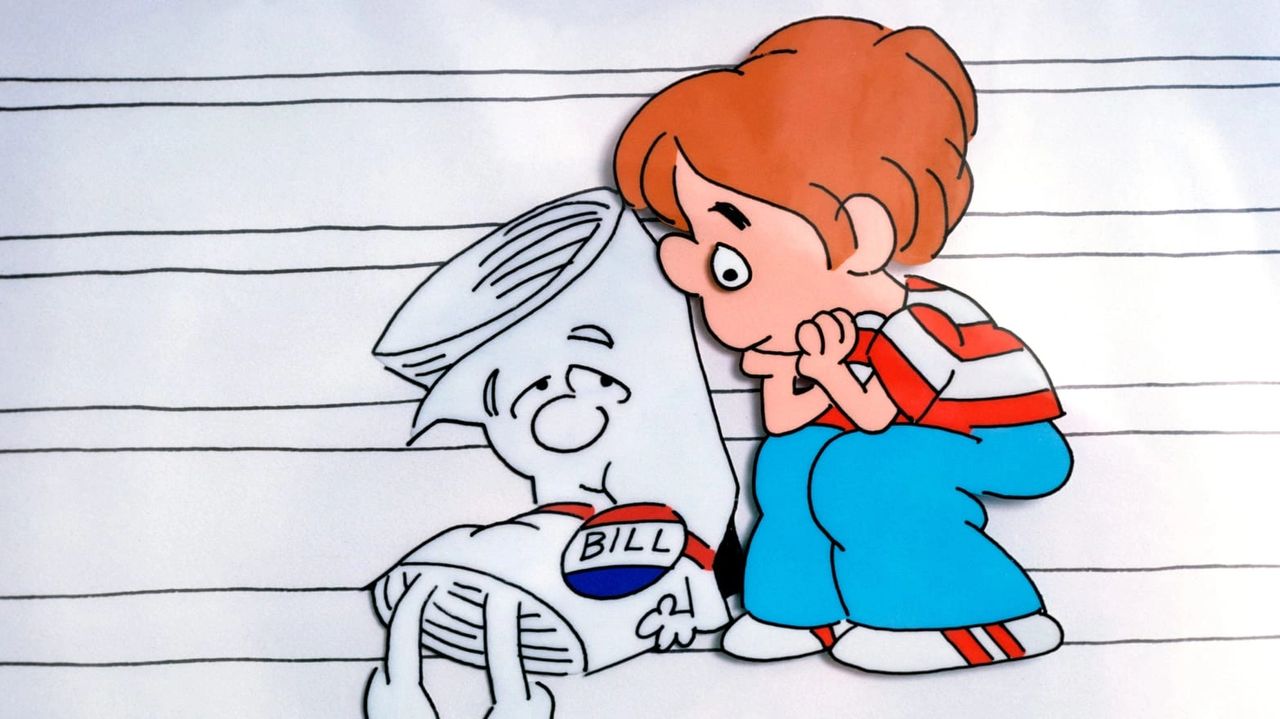

As a Gen Xer, I grew-up watching cartoons on Saturday mornings. In between my favorites, I loved watching and singing along to the short music-filled lessons from Schoolhouse Rock! These shorts covered grammar, science, economics, history, math, and civics lessons. The series ran from 1973 to 1984, but I think we’re in need of more civics lessons today! I’m not saying this because my two teenage daughters are clueless about how our state & federal government works (although there’s some truth to this statement)…it’s because of what I’ve witnessed as a result of the discussions around a potential public Long-Term Care (LTC) program in California.

Here’s an indisputable fact – LTC is a BIG issue in America and in California (CA). And it’s going to get bigger as more CA residents age and begin to need LTC support and services. According to KFF, 62.5% nursing home residents are on Medi-Cal. That number will continue to grow as our state ages and if more residents don’t plan for extended healthcare. So as a response to this significant risk to our state’s population and budget, AB 567 (Calderon, Chapter 746, Statutes of 2019) established the Long Term Care Insurance Task Force to explore the feasibility of developing and implementing a culturally competent statewide insurance program for long-term care services and supports.

That’s right, the state is studying this issue. But that’s it. They’re just studying the issue. There’s not been a bill submitted to the legislature or law that’s been passed. This may lead to legislation or a program…or it may not. The LTC Insurance Task Force produced a feasibility report which included preliminary plan design options and in 2023 they’re analyzing the potential costs to the state and it’s residents. Unfortunately, not enough of our brethren sat behind TVs for countless like me on Saturday mornings or were schooled in civics lessons. We’ve seen numerous marketing emails directed towards employers and individuals in CA that misstated or misrepresented where we stand today. Many of these emails assumed that this feasibility report would definitely lead to law and some emails even pushed dates in which people must purchase LTC Insurance in order to qualify for an exemption from any forthcoming tax.

Misleading email after email crossed my desk and I just didn’t have the time or energy to play “Whac-A-Mole” and correct. But Ricardo Lara (CA’s Insurance Commissioner) did have time and issued an email on August 23rd to all licensed agents in CA with a stern warning about false and misleading marketing tactics. He shared, “In short, the Legislature has not made any decisions about a public program at all, no payroll tax is being implemented, and there is no “opt-out” date at this time.”

Not misstating the process or work of the CA LTC Insurance Task Force is a no-brainer. I think the real lesson here how we communicate the value of this planning. My suggestion is to NOT lead client conversations with tax avoidance. We should be leading our conversations with the important of planning for LTC – helping protect families, retirement income and lifestyles. And then if you want to bring up the bigger issue for the state and how CA is studying ways to help residents plan and finance LTC events, then go for it. But stick to the facts vs. guesses and you may want to watch my favorite Schoolhouse Rock lesson!

%20%232.png)