Planning Tips and Carrier News for Advisors

Never miss any update

Subscribe to the Planning Tips and Carrier News for Advisors newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

It happened to me too!

I screwed up. I waited too long to have the talk and now we're all paying for it.

I know, it sounds heavy right? What am I talking about? My mom.

She's turning 85 in September and has been living in an assisted living facility for the last 18 months. It's a beautiful place, 10 minutes from me and she's happy over there. That's what's most important. But financing her care ($12,000/month) is the painful part of this story! By the time I talked to her about LTC Insurance, it was just too late. She was uninsurable. So, we're self-insuring by default.

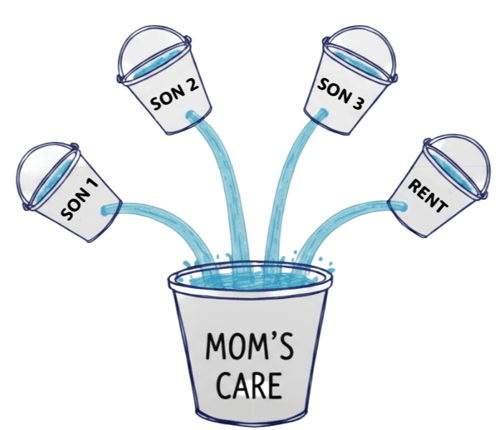

Here’s a look at the math -- yes, it’s $12,000/month for her care in the suburbs of Los Angeles. And I think/hope she can live for a few more years – she needs help with her ADLs, medication management, but she’s stable and somewhat active. From a financial standpoint, it’s already wiped away her life savings and now requires my brothers and I to split the monthly bill (which recently increased). We didn’t want to sell our childhood home, so we remodeled it and rented out for about half the cost of her assisted living facility charges. That means we cover the other $6,000/month, with each son paying $2,000/month out of pocket.

We’re so fortunate to be able to spend time with Mom and help, but it’s been challenging to say the least – from managing her health care, attending so many doctor appointments, making the move from home healthcare to assisted living, the remodel and the family dynamics that came into play during all of this.

Ready for the moral to the story? Planning ahead is critical, whether your clients are like my mom (of modest means) or ultra-affluent. It’s critically important to have a plan for LTC twenty years ahead of an extended care event vs. scrambling for resources or answers 20 minutes after! LTC Insurance could have saved our family hundreds of thousands of dollars, reduced our blood pressure/stress levels, and would have provided us with guidance and support as we navigated this care event. That’s what drives me each day – I want to share my story to help advisors and clients plan for Long-Term Care, which is becoming a reality for so many families today.

%20%232.png)