Work with a specialist to help you with each building block.

They can help you add finishing touches so your insurance plan provides meaningful benefits that fit your budget.

Where planning is easier.

Assistance with activities like bathing, dressing, or getting up from a chair. It is sometimes called Custodial Care.

Care from skilled or licensed medical personnel such as physical therapy and administering certain medications.

To help you if you get Alzheimer’s Disease or other kinds of dementia.

Health insurance, the Affordable Care Act, Medicare and Tricare are not designed to cover Personal Care, Professional Care, or Supervisory Care. Medicaid (MediCal in California), may cover some long-term care expenses but requires you to become impoverished to qualify.

As a result – There can be significant consequences to you and your family if you fail to plan for long term care expenses.

Without long term care insurance, you pay for the costs of long term care.

The proper long term care insurance plan can help you have more choices in the type and setting of care you receive.

We don't imagine asking family to help. Without proper planning, what choice are we leaving them? Owning the right insurance can help those you have spent a lifetime protecting.

Get a QuoteThe Three Building Blocks of Long Term Care Insurance

Work with a specialist to help you with each building block.

They can help you add finishing touches so your insurance plan provides meaningful benefits that fit your budget.

Our specialists make it easy to understand and own an insurance plan to help address what is important to you and your budget.

Select from three convenient options to receive a personalized quote.

Think of it a bit like a checking account where the Total Maximum Benefit is your account balance and the Total Monthly Benefit is the most you can take out each month for your care.

Total Maximum Benefit options generally range from $50,000 to $500,000, with some plans offering an unlimited maximum.

Total Monthly Benefit options typically range from $1,500 to $10,000 a month.

Most people select a Total Maximum Benefit between $100,000-$250,000 per person and a Total Monthly Benefit between $3,000-$5,000 per person.

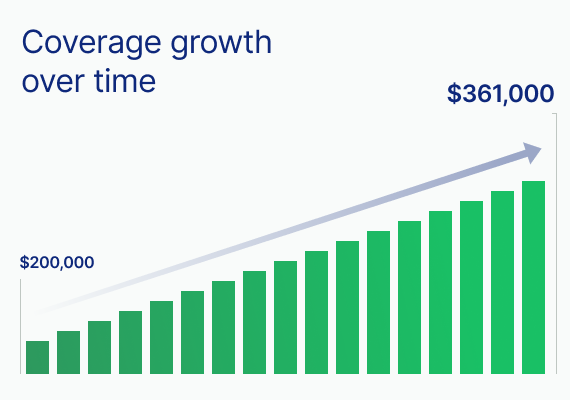

This building block grows the amount the insurance company will pay to help keep up with rising costs. For example, a policy with a $200,000 total maximum benefit and a $5,000 total monthly benefit, growing at 3% each year for 20 years, would grow to over a $361,000 total maximum benefit and to over a $9,000 total monthly benefit.

There are a wide range of options for growth, ranging from not growing the amount the insurance company will pay, to growing it slowly, or growing it at a faster rate.

The most popular choice is a 3% annual compound growth. The next most popular approach is a “no growth” plan where the amount the insurance company will pay remains the same over the life of the policy. Our specialists can help you determine which approach helps meet your needs and budget.

Do you want someone to get money back for coverage amounts you did not use? Choosing a money back option means your plan is not “use it or lose it.” Either long term care benefits are paid by the insurance company for your care, or your beneficiary gets a cash benefit.

There are three basic options:

It’s a mixed result. Because it will cost you more to own a policy with a money back option, it becomes a balance between owning more meaningful long term care insurance benefits and whether money back is important to you. Our specialists can help you compare to get the plan that helps fit your needs and budget.

Our specialists focus on your needs.

We work entirely by phone.

Our experienced representatives help you own meaningful benefits that fit your budget.

Weekdays, 8-5 Central. We strive to accommodate after hours and weekend requests. Please share your preferred time to be contacted and we will do our best to accommodate it.

Select from three convenient options to receive a personalized quote.